- #Example of inventory list how to

- #Example of inventory list verification

- #Example of inventory list code

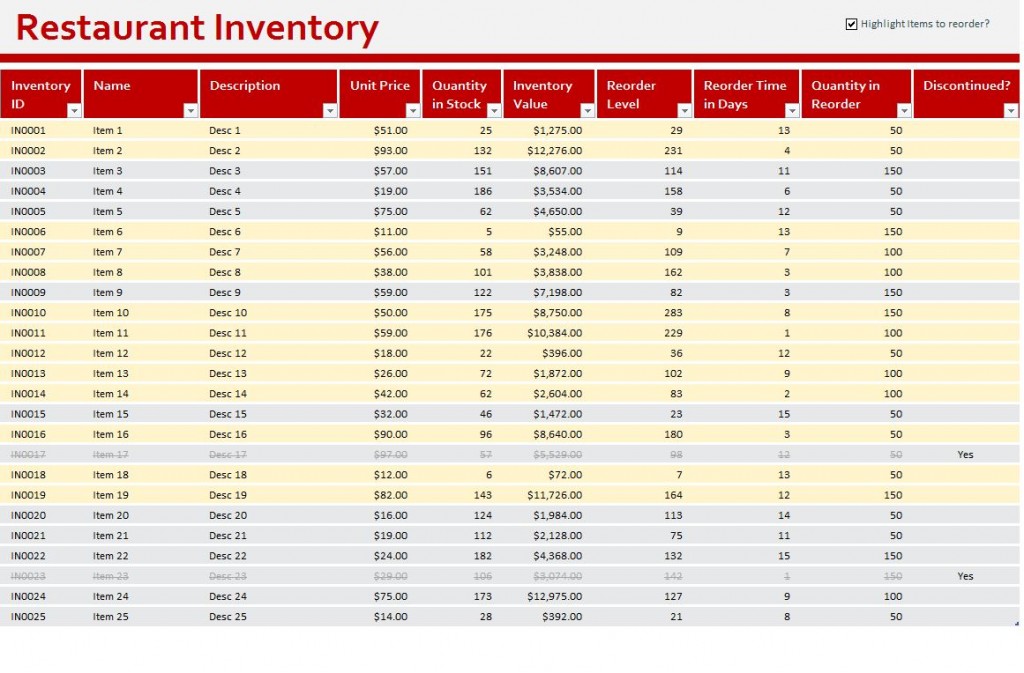

Total Sold items at the end of the year were 65. These methods are a weighted average method, FIFO, and Specific Identification. There are many inventory valuation methods, but not all accounting inventory valuation methods are acceptable by the Bureau of Internal Revenue.įor the discussion, I’ll mention only three of those inventory valuations for the annual inventory list.

In this column, you have to specify what method you use to arrive at your unit cost per item or product. So make sure that your descriptions of items are the same as the consigned goods or commodities. The BIR will investigate any differences in the reported stock. These items as consignments should have duplicate records in the consignee’s forms.

#Example of inventory list code

Let me tell you what code you should for your goods on hand and goods on consignment.

#Example of inventory list how to

How to Register Your Business as Barangay Micro Business Enterprise (BMBEs).How to Reduce Your Philippine Tax in 2020.

#Example of inventory list verification

How to Get TIN Number Online and the Verification Philippines 2020.If the private address is the same as the business, then you can use it. In the address, you need to specify the business location, not the personal address. These columns are used if your products or items are on consignment, parked goods, and goods you put on consignment. For example, you can mention the brand name or use it as white or brown for sugar. Make a brief description of your items or products. However, you can use a short inventory code that could help you to differentiate. Suppose you maintain the coding for each item or product that would be better. In this column, you have to indicate all the unsold stocks you have. Let me use Annex A for retail and manufacturing companies.

To make sure you’re doing it right, I’m going to explain each term and column. You might not be familiar with many columns or not sure how to fill up that column. How To Do Inventory Listing BIR- Step-by-Step Those who are engaged in construction and contractor agents must use this template. This template is available for engaging in buying and selling natural properties or even real estate developers.

Related: How to Start Sari-sari Store Annex B: Real Estate Industry Examples are a salon, barbershop, and even boarding house. However, it excludes anyone who is rendering services to the clients. This template includes those who are selling dry goods. Use this template if you are engaged in selling items both online or not. This memorandum requires all those businesses to sell goods or items, real estate dealers or developers, manufacturers, retailers, wholesalers, and those involved in construction.Īnnex-download Annex A: Retail/Manufacturing The Bureau of Internal Revenue issued Revenue Memorandum Circular No.

In this article, I’ll show you how to compute unit costs according to the BIR standards. If you’re required to submit this document, here are the proper ways to make the yearly inventory list and the sworn statement. The BIR requires businesses to trade or sell goods to submit the annual inventory listing before January 30. So, what are you waiting for? Let’s get started! We’ll also provide some tips on how to make the process easier. In this blog post, we’ll outline the steps you need to take to get started. However, it’s important that you take the time to prepare an accurate inventory listing so you can keep track of your company’s finances. Are you feeling overwhelmed when you think about preparing your business’s annual inventory listing? Don’t worry, you’re not alone.

0 kommentar(er)

0 kommentar(er)